The Comprehensive Guide to Crypto Investing

WAGMI

Disclaimer: This is not financial advice and I am not a financial advisor. This article is for entertainment purpose only. Trade at your own risk.

Thank you for reading this article. I’ve been involved in trading & investing in equities for 9 years now and got into crypto in 2017. From trading penny stocks and going through the 2018-2019 crypto bear market to witnessing the March 2020 liquidity crisis and multiple DeFi rug pulls, I’ve experienced a few events that helped me distill several investment principles that I hope you’ll find useful.

I. The Difference between Trading & Investing

The first thing to understand is the difference between an activity, trading, that leads you to seek short-term profits in opposition to investing, which implies a preference for long-term gains. It essentially all comes down to the timeframe used to make your trades and whether you’d like to take advantage of volatility on smaller timeframes to make money.

Being a part-time trader is extremely difficult and this is an activity that typically requires you to dedicate 100% of your time to it. While basic technical analysis concepts such as support / resistance, price & volume relationships and indicator strategies are easy to understand, execution is a completely different ball game as it will get corrupted by emotions a trader will experience in the process.

There is never a good time to start trading: it’s definitely not something you should start to make money after you quit your job or to make more money after you exited a long-term investment, because you’ll lose your principal if you’re new at this. It’s probably best to start when you’re young and when your capital is still small so that your risk is limited. However, do not expect to generate any gains within your first 2-3 years of trading, but do expect getting wiped out a couple of times. If you do decide to trade, use spot only first (no derivatives) to cut your teeth and define your trading system (entry triggers, target risk-reward ratio, stop placement & invalidation, exit target).

There are several quality resources on trading such as Crypto Cred’s Technical Analysis Lessons that you can start with. In addition, do check out Paracurve, Adam’s TradingRiot and BitDealer’s YouTube videos.

The possibility to use only a small percentage of your capital as a trading account can be viable if you’re able to properly discern the necessary skills between trading & investing. Most of the time, the lines are blurred and your trading capital soon becomes a bagholding account because proper risk management wasn’t enforced.

II. Learning Basic Technical Analysis for Investing Purpose

While trading is not the main topic of this article, I do believe that learning basic Technical Analysis is going to significantly enhance the performance of your investments.

Blindly buying coins at random prices purely based on memes or because you’re emotionally involved in a community might get you somewhere for a moment, but will eventually leave you without capital over long run. This is because you won’t foster the right investing habits and while you could make a good return on your first investment, you will get hit in a second or third “arc” of your investment career.

Therefore, don’t marry your bags and be very strict with your entries by having a sense of whether the price is closer to a long-term top or bottom. In that order you must absolutely use high timeframes such as monthly, weekly or daily if you’re investing in something you’ll hold for weeks or months.

ETH/BTC, 1W, a HTF entry preceding a 262% move

Whoever tells you that getting in BTC at USD 4k or 8k doesn’t matter over the long run is delusional: it’s the same as saying that getting in at USD 30k or 60k won’t matter. It obviously does unless you enjoy taking 50%+ drawdowns right after your entry. Whether you’ll have twice as much capital in the future depending on whether you FOMO’ed at the top or waited for a significant pullback is an important fact to consider.

That being said, it’s also crucial to avoid fading trends and be sharp at identifying reversals followed by impulse moves to avoid being sidelined for too long. A good example was the BTC run from USD 3.2k to 14k during the first part of 2019. Considering the entire move being very sharp with barely any retrace, waiting for a ~USD 4k or 5.5k retest would have gotten you sidelined.

BTC/USDT, 1D, run from the 3.2k bottom to 14k

However, bear in mind that violent moves often create low liquidity zones as outlined in blue, and those tend to get re-visited at some point in time. The market is always trying to distribute trade volume or time spent evenly across price levels. This is why tools such as VPVR (Volume Profile Visible Range) or VPSV (Volume Profile Session Volume) are quite important to confirm what’s already visible through the price action.

Another method to assess whether you’re getting a good deal on your entry is to use Fibonacci levels. When BTC was priced at USD 4.1k, I realized that it had experienced a 79% pullback and was also trading under the 0.786 Fib level. Overall, I considered that it was an attractive level considering the high conviction I had for Bitcoin in the future.

BLX/USD, 1W, Fibonacci Retracements applied to BTC from the 2015 bottom to the 2017 top

Unfortunately the capital deployed at USD 4.1k was only a fraction of what I had available and the rest of the capital was sidelined during that 3.2k to 14k move.

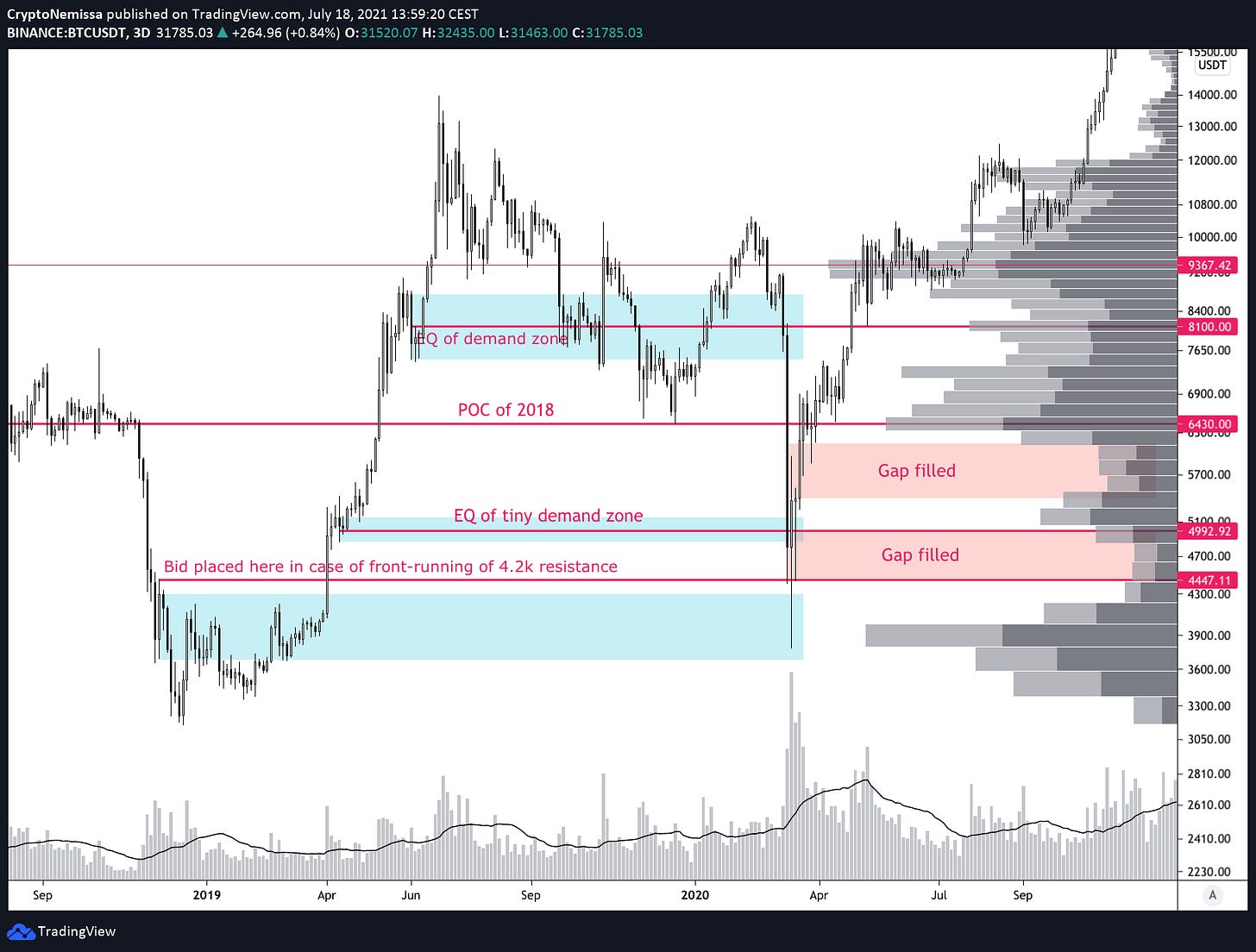

When everything started to feel heated at the 14k top, I stacked bids between 4.5k to 8.1k. One reason was the low-liquidity areas created during the violent impulses in the preceding macro move.

BTC/USDT, 1D, illiquid areas created from strong moves

Remember, the market tries to distribute time spent or volume traded evenly across price levels, so these liquidity gaps are likely to get revisited to distribute more time or volume in these areas.

Here are the price levels where my bids were placed:

At the EQ of the demand zone 7.6k to 8.7k

At the 6.4k POC of 2018’s VPVR

At 5.1k, which was tiny demand zone

At 4.4k: the high of the breaker candle to prevent any front-running for the 4.2k resistance.

BTC/USDT, 3D, bids placed after PA demonstrating bearish market structure following the USD 14k top. Notice that the gaps are now filled

Needless to say the March 2020 liquidity crisis was a bit of blessing that got my bids filled. Though I remember setting them in end September 2019, so it took a little over 5 months to get there. This taught me three things:

Resist FOMO at all cost when a move already benefited from significant upside as there will be opportunities to buy later down the road. This proves to be true again this year with BTC retracing from USD 64k to 28.8k. We might not even be done as there is an illiquid area at USD 24-26k.

Catch HTF reversals as early as you can as they won’t give you shorter-term pullbacks to deploy your capital, considering how sharp they can be on the upside. This was also true when BTC went from the March 2020 low to USD 64k

Despite having these crisis-type moves being fundamentally driven (March 2020 was COVID related), it’s almost like the technicals are flashing warning signals in advance (bearish market structure, gaps, etc.).

I realize the first two advices are somewhat conflicting but they can be simplified as:

Buy breakouts of significant HTF level: this actually worked really well as regards to getting into DeFi tokens in early January 2021

Don’t chase overextended or parabolic moves: if it already has 3-4 impulses on a Weekly or 3D timeframe, it’s likely that you’re getting in way too late. It’s probably better to stack bids at key levels or demand zones, providing you with a better average entry

Violent moves whether to the upside or downside (e.g. massive single candles with barely any retrace) will most likely get revisited as some point in time. Many buyers or sellers are left on the sidelines of these: there are still a large amount of stacked orders left there, prompting the market to go grab this resting liquidity.

In conclusion, buy HTF level breakouts EARLY in the trend or stack bids at key HTF levels if you’re LATE in the trend. Then enjoy the ride, at least for some time, which leads to the next part.

III. Taking Profit is Essential

I can’t stress this enough. Yes, a move could still have some juice left when you sell. Though, you’ll never be able to time the top so you might as well take profit at some point. Similarly to stacking bids when you want to get in a long-term investment, you should plan to sell part or the totality of your positions. Not only you will realize gains, which is always a positive thing, but you’ll also have enough cash to re-invest when price action goes awry and your target assets take a 65%+ haircut.

The biggest trap is to see your portfolio take a 15%-20% drawdown from its ATH, and avoid taking the “loss” because it’s emotionally painful. This is how people end up riding altcoins to the abyss (think 95%+ drawdowns). To avoid going through that, liquidating part of your positions on the way up is a much more positive emotion, providing you don’t experience fear of missing after that. Another way would be to sell as soon as you notice a bearish break of market structure on the HTF, although those down moves are extremely violent as well and by the time you notice, you’re already 50% down (e.g. BTC 2017 top).

BTC/USDT, 3D, The start of the BTC bear market after the 2017 top

After -44%, it’s emotionally extremely difficult to make the right decision and liquidate the position. This is how the market leaves you holding the bag.

The most cruel part is that after these significant drawdowns, most people will actually need the money left to go on with their lives, which would lead them to realize a 95% loss.

Indeed, it’s very easy to feel underexposed in bull markets and investors tend to deploy all of the capital available because the market keeps going up and they think they can always cash out later. This is how brutal markets are, they will take you down with them, then leave you in the dust following a swift reversal.

Consequently, a key habit is to always have ammunition at your disposal to buy HTF pullbacks and one way to get there is to take profit and pay yourself on the way up.

IV. Do Your Fundamental Research

This part could be a bit more controversial for crypto considering that we saw “dogs” & “community” coins go 100x. In addition, most coins are highly correlated, despite whatever narratives was at the USD 64k BTC top:

ETH will flip BTC’s market cap: not saying it can’t happen but historically, flippening talks are a damn good top signal

ETH will de-correlate from BTC’s PA. Right, this is actually slightly true during bull runs and we’ll get to that later. But bear in mind that if BTC crash and burns, everything else does, besides some outliers like LINK during the 2018-2019 bear market or AXS right now.

Nevertheless, you should formulate an investment thesis when you decide to get in a project, rather than going into coins with low utility or relying on future promises only (mainnet or smart contract release).

It’s always easier to invest in something that you are actually using. For me, it would be protocols like SUSHI or AAVE that have excellent working products with billions of dollars in TVL. That might not be your next 100x but I’m not necessarily in a rush and a 10x will suffice.

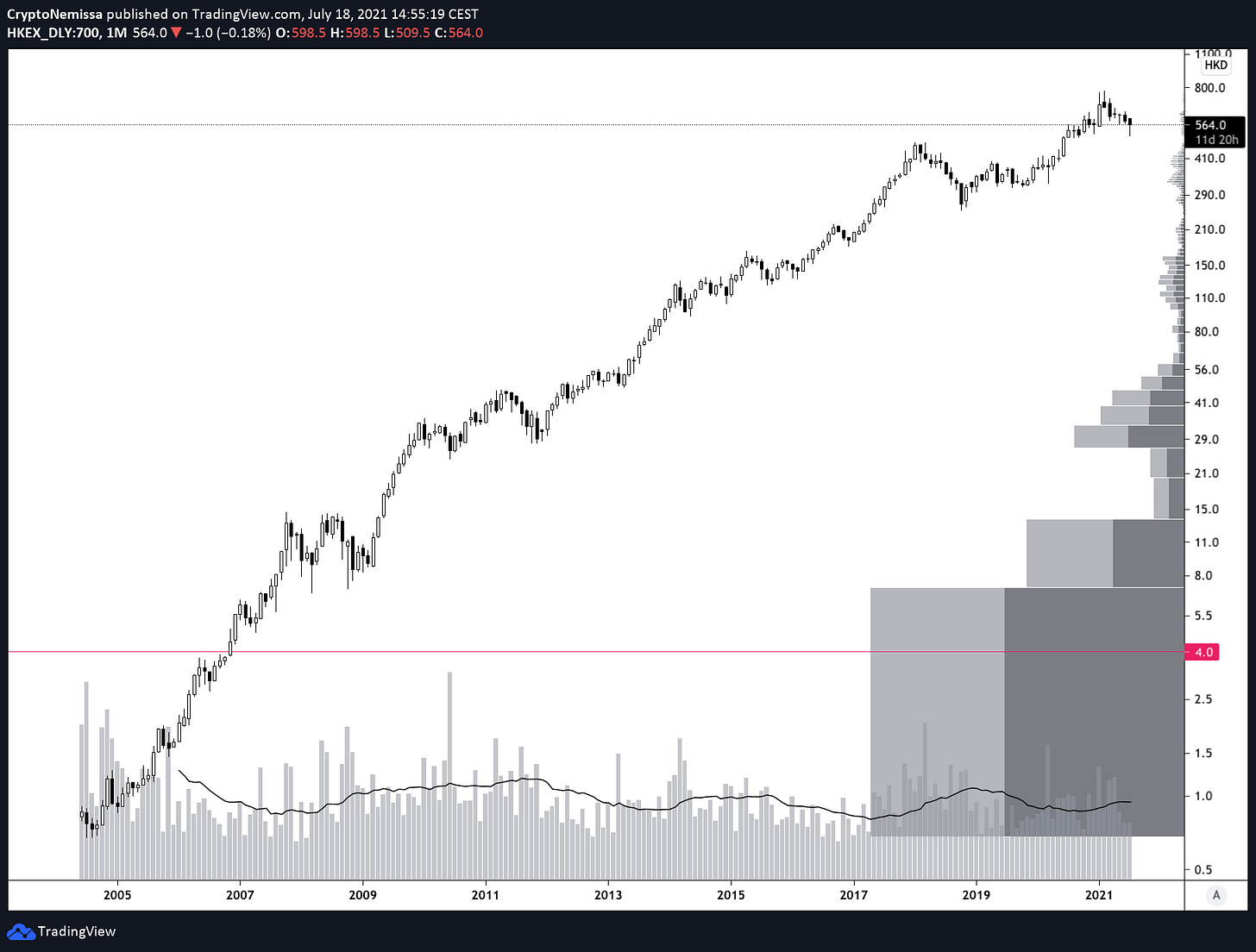

One of my best equities investment was in Tencent (HKEX) from 2015 to early 2018, when I was living in China. WeChat Pay was spreading like wildfire in 1st tier-cities but with the potential to be scaled to most of the country, which would obviously have an impact on the stock price. It eventually did and literally everyone from your street vendor to bars & restaurants ended up taking WeChat Pay (or Alipay) as a mean of payment, even more than debit or credit cards. This was a thesis I was comfortable failing with.

Tencent, 1M, Up Only

V. Investing in Low Cap Gems

I’ll be very clear about low cap gems. There are vastly successful people on Crypto Twitter able to identify and profit from them, but consider the money invested wasted. Low cap coins are low cap for a reason: most of them don’t have a working product and often rely on a roadmap, innovation or technical promises to get investors. If you’ve been through the 2017 ICO phase, you know that most of these projects are deemed to fail.

If you do take low cap path (1-50 Mil Market Cap), be sure to spend tons of time auditing what’s going on in the project: talk to the developers, have a way to check if the code is actually being pushed, hang out on the discord and telegram channels. Another thing about low caps is that the associated marketing is usually poorly executed so it’ll never reach the target audience. This should be part of your concerns if nobody ever hears about the project on Twitter.

Ultimately, you might be better off going for a 100 M+ MC coin with a working product and strong metrics ( e.g. daily active users).

VI. Preserving Capital is Key

One recurring theme in crypto is to focus on survival, and it entails preserving capital. Until you become proficient in crypto investing, your drawdowns will be massive, more than anything you’ve experienced anywhere else. Accordingly, always make sure to keep a significant portion of your capital to re-invest when the market bottoms. This can be done by having HTF invalidation levels on the chart once you’ve entered or simply re-assessing projects along time to see if the fundamentals you’ve initially bet on are going in the right direction.

“Make Something People Want” is YCombinator’s motto and “Invest in Something People Want” should be yours.

VII. Correlation of Cryptocurrencies

Are all crypto coins correlated? The short answer is YES, highly. At least for now. That being said, there are effective capital rotation strategies that can be implemented over the course of market cycles. For example, you might have noticed that in December 2017-January 2018, BTC topped about 1 month before ETH:

BTC top: 17/12/2017

ETH top: 13/01/2018

LTC top: 12/12/2017

BNB top: 11/01/2018.

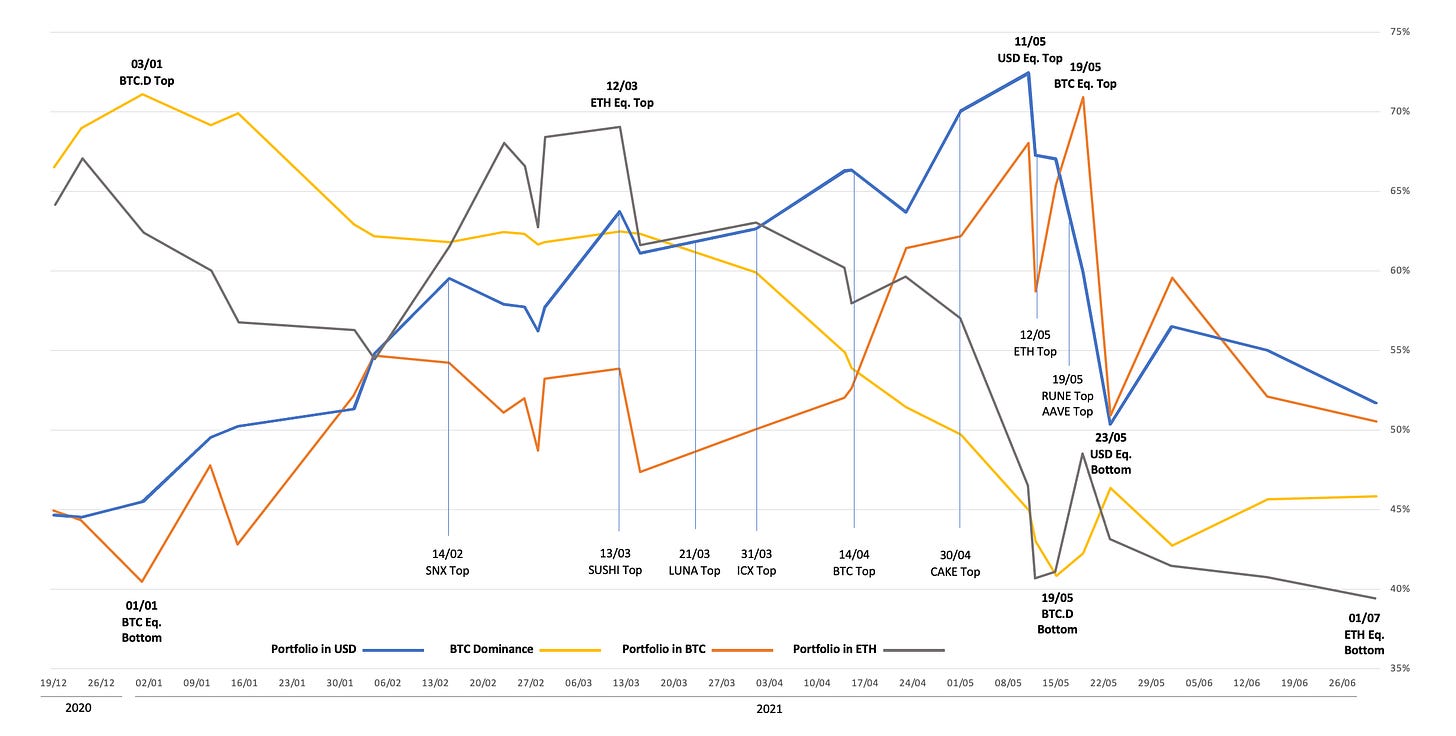

From that observation, I have tracked a portfolio made of 69% BTC, 12% ETH and 19% DeFi Alts (at 11/01/2021) during the first part 2021. The objective was to identify the level correlation between cryptocurrencies and observe the performance of the portfolio in USD, BTC & ETH terms, while also plotting BTC dominance. You will find the results below (USD, BTC & ETH values deliberately taken off the chart):

A portfolio’s performance denominated in USD, ETH & BTC and BTC dominance over late 2020-S1 2021

The first thing to notice is that going all in ETH on 12/03 could have been an interesting strategy considering the portfolio denominated in ETH was at ATH, which implies a weakness of ETH until that date. I do remember tons of jokes on Twitter directed at Ethereum maxis, regarding the PA at the time, so this could have potentially been a signal. Notice that SUSHI topped almost at the same time (March 13th).

The USD denominated portfolio topped on 11/05, very close to ETH top on 12/05 and 28 days after BTC topped on 14/04. Guess what? ETH topped 27 days after BTC in end 2017-early 2018. History never repeats itself, right?

Other notable facts are SNX topping way before any other coin, on 14/02. This could be used as a future reference in upcoming bull runs: SNX tops first, SUSHI a month later, BTC a month later, ETH a month later, then bears take over.

Please note that this is very preliminary research and that I have yet to define a proper investment strategy based on this data, but it could be the core of a next article. One key question is especially to determine how to allocate capital in a portfolio at the beginning of bull runs: if you take a look at AAVE, SUSHI and SNX, they pretty much got started at the same time in early November 2020. The second best entry for DeFi was early January. I encourage you to look at what BTC.D was doing back then.

DeFi Perp, 1D, a nice entry on the break of the USD 2,675 resistance

Note that the optimal time to get into ETH for that specific portfolio was about at the POC level (USD 10,382) of the DeFi Perp basket.

BTC.D, 3D, Portfolio ATH & DeFi entries

Cool fact, the 1st entry in DeFi is at the exact EQ of the BTC.D range between 58% & 73%. Not exactly sure if that’s of any significance. Entering DeFi after the re-test & rejection of 73% level was a very lucrative play considering the subsequent performance of the DeFi Perp and the underlying tokens such as SUSHI, AAVE or RUNE.

In closing, you can successfully find technical confluence between different key metrics of the crypto market to help you make strategic investment decision. Additional data to explore would be ETH & DeFI dominance as well as DeFi:ETH ratio to figure out whether entry triggers can be created for capital rotation purposes.

Conclusion

I will now wrap this article as this is turning into a book. While investing may seem easy as it is often broken down into buy low sell high, there are intricacies that will unveil themselves once you dive into the technicals & fundamentals. Researching the latter is key to formulate your investment thesis while learning basic Technical Analysis is critical to help you define entries, exits and invalidations.

Developing a capital preservation mindset can be catalyzed by simple habits such as taking profit on the way up and paying yourself.

It is also to your initiative to track your portfolio performance, denominated in USD, BTC or ETH to effectively define capital rotation strategies in order to make your capital grow over time. While cryptocurrencies can be highly correlated on the way down, this is playing slightly differently on the way up as some assets consolidate while others appreciate, and vice versa. Finally, there are always outliers out there that tend to vastly outperform the rest of the pack. Find them early and you could turn a bear market into a personal bull run.

For more content, follow my twitter account: @0xNemissa.